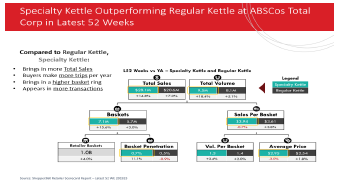

Return to growth with underperforming brands

CHALLENGE

- A client acquired two brands that had fallen off in sales during old leadership

- Both brands needed

strong, concise insights

to help demonstrate the brands’ potential

solution

- Track opportunities and progress by division via reporting suite

- Showcase strengths

of each brand

- Connect with corporate leadership on divisional opportunities

RESULTS

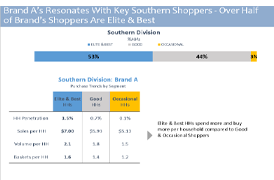

- Brand A: Sales +32% vs YA in 2019 (vs +0% vs YA in 2018) with gain of 17pts of ACV

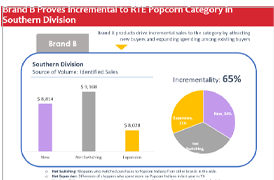

- Brand B: Sales +9% vs YA in 2019 (vs -10% vs YA in 2018), acceptance of new sub brand into category in largest division

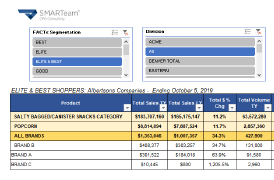

Reporting suite to track business opportunities

Demonstrate appeal to Elite & Best households

Prove incrementally of recently expanded items

Leverage success to launch into a new category

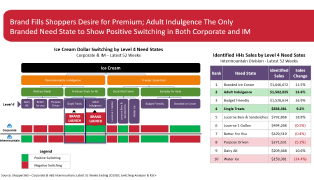

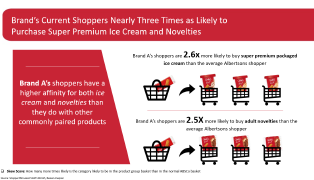

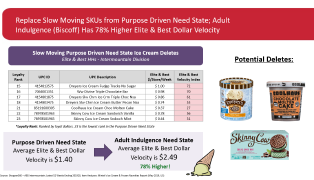

CHALLENGE

- Brand showed promise from current categories, but looking to launch into the ice cream and novelties segments

- Buyer in new category had limited experience with brand’s current portfolio

solution

- Demonstrate areas of growth for divisions using Shopper360-based category insights

- Prove opportunity exists for new items and what can be removed to make space

- Show trial and repeat rates after launch to gain expanded assortment

RESULTS

- Initial meeting with division yielded 50% of new line getting cut in late 2019

Additional insights from follow-up after launch led to remaining items getting added

Identify category growth areas for division

Demonstrate shopper likelihood to buy

Assess underperforming items for new space

Fix a market void

CHALLENGE

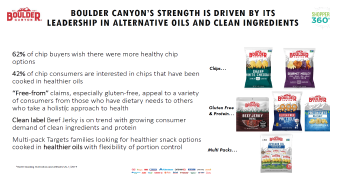

- Key health-focused brand in a Salty Snack manufacturer’s portfolio cut from many divisions in previous years

- Relationship with western divisions lacking, and education on brand direction limited

solution

- Secure involvement in corporate-sponsored wave reset planning meeting

- Demonstrate direction of the brand via insight-driven innovations

- Leverage insights to present to each division about local assortment opportunities

RESULTS

- Each division in attendance to review brand’s portfolio

- Projected 7,300 new points of distribution secured via divisional follow-up meetings for upcoming reset

Connect insight to innovation and educate

Leverage shopper loyalty information

Demonstrate divisional opportunity

Fast answers to your specific business question

CHALLENGE

- Identify shelving preferences of category shopper at a specific retailer

- Understand how shoppers prefer category to be shelved: Brand vs. Lifestage

solution

- SMARTgauge survey –

a fast and affordable survey which provides direction to a single business question in just 7-10 business days from launch of survey

RESULTS

- An overwhelming majority of shoppers prefer the category to be organized by Brand versus Lifestage

Market research supported changing shelf merchandising strategy, reversing large brand recommendation and protecting smaller brand’s presence

Brand: 72%

Lifestage: 28%

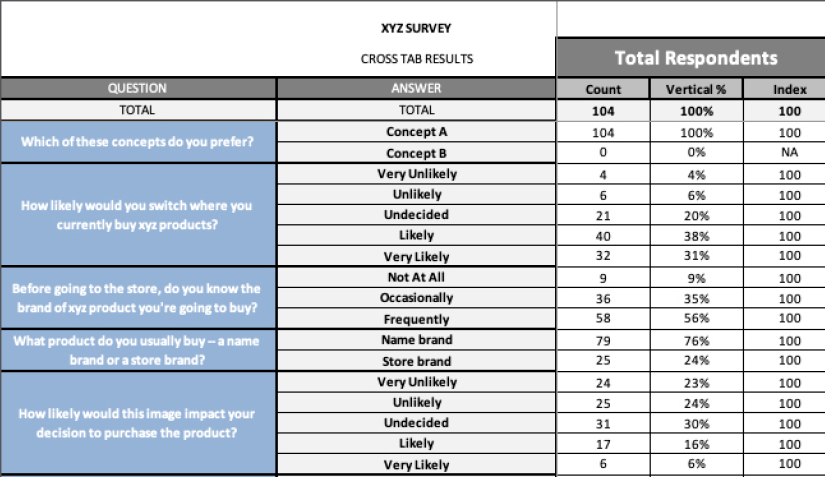

Quick feedback to guide marketing decisions

CHALLENGE

- Identify usage occasions of a product

- Understand if a specific claim resonates with shoppers

- Compare one product to another

solution

- SMART SnapShot: This short survey gives you quick feedback, so you can design and iterate swiftly

- Use it to help guide decisions and support hypothesizes

RESULTS

- Output includes raw data file, key findings and Crosstab report

- Results in 2 business days with national sample

Key findings

Crosstab report